irs federal income tax brackets 2022

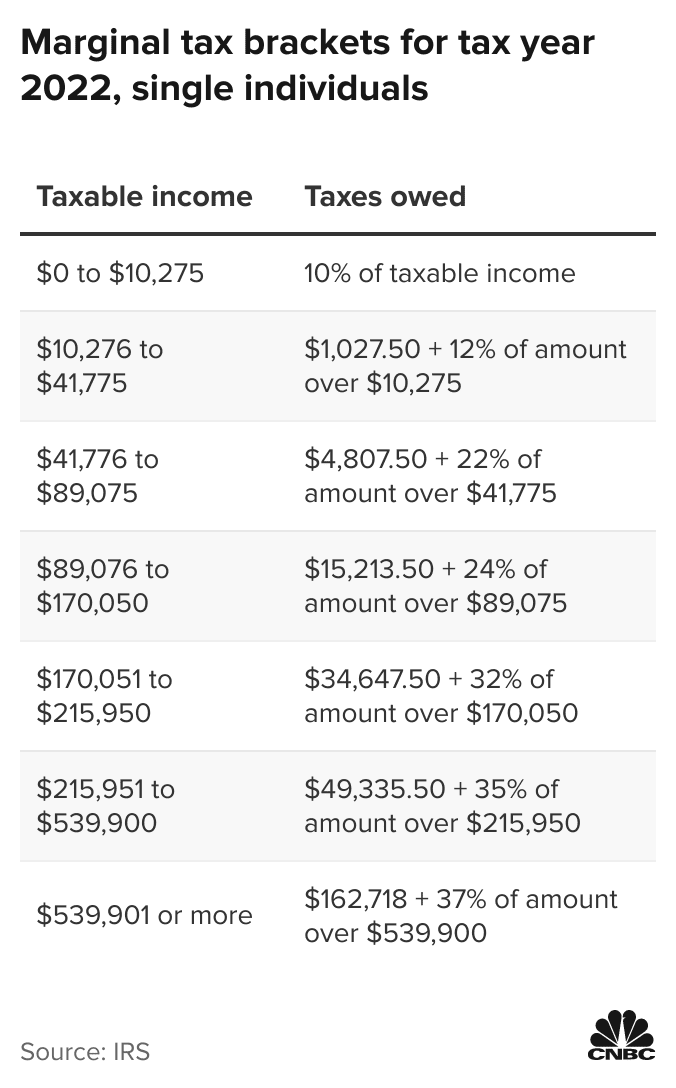

The top tax rate for individuals is 37 percent for taxable income above 539901 for tax year 2022. 6728 for tax year 2021.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Married Filing Jointly or Qualifying Widow er Married Filing Separately.

. If Taxable Income. Importantly the 2021 brackets are for income earned in 2021 which most people will file taxes on before April 15 2022. In 2022 the income limits for all tax brackets and all filers will be adjusted for.

Plan Ahead For This Years Tax Return. Tax brackets for income earned in 2022. Your tax bracket is determined by your filing status and taxable income for the 2022 tax year.

Get help understanding 2022 tax rates and stay informed of tax changes that may affect you. If youre a single filer in the 22 percent tax bracket for 2022 you wont pay 22 percent on all your taxable income. And since the federal income tax brackets for the 2022 tax year are already available you can start thinking about how to handle your 2022 finances in a.

10 announced new tax brackets for the 2022 tax year for taxes youll file in April 2023 or October 2023 if you file an extension. 2022 tax brackets are here. The tax items for tax year 2022 of greatest interest to most taxpayers include the following dollar amounts.

See below for how these 2022 brackets compare to 2021 brackets. For the 2022 tax year there are also seven federal tax brackets. The standard deduction for married couples filing jointly for tax year 2022 rises to 25900 up 800 from the prior year.

Using 2022 tax brackets heres how theyll be taxed. 19400 for tax year 2022. There are seven federal tax brackets for the 2021 tax year.

25900 Single taxpayers and married individuals filing separately. Be Prepared When You Start Filing With TurboTax. 7 rows 2022 Individual Income Tax Brackets.

The maximum Earned Income Tax Credit for 2022 will be 6935 vs. Ad Compare Your 2022 Tax Bracket vs. The final 8225 of income falls into the 22 tax bracket resulting in a tax of 180950.

The Internal Revenue Service has released 2022 inflation adjustments for federal income tax brackets the standard deduction and other parts of the tax code. 8 rows 2022 Federal Income Tax Brackets and Rates. There are seven tax brackets for most ordinary.

Married Individuals Filling Seperately. But instead of paying. The personal exemption for tax year 2022 remains at 0 as it was for.

10 12 22 24 32 35 and. Income limits for all tax brackets and filers will be modified for inflation in 2021 as stated in the tables below. Tax planning is all about thinking ahead.

Download the free 2022 tax bracket pdf. 10 12 22 24 32 35 and 37. There are also changes to the.

The next 31500 of income falls into the 12 tax bracket resulting in a tax of 3780. You will pay 10 percent on taxable. Standard deductions and about 60 other provisions have been adjusted for inflation to avoid bracket creep.

Married couples filing jointly. Federal Tax Brackets 2022 for Income Taxes Filed by April 18 2022. The IRS on Nov.

In 2022 the income limits for all tax. IRS announces plan to end pandemic inventory backlog 0656. 12950 Heads of households.

For example a single person who made 100000 in taxable income last year would fall into the 24 tax bracket. Importantly your highest tax bracket doesnt reflect how much you pay in federal income taxes. Inflation pushes income tax brackets higher for 2022 The IRS has announced higher federal income tax brackets for 2022 amid rising inflation.

Ad Learn More About Tax Brackets And Federal Income Tax Rates And Start Filing w TurboTax. 7 rows 2022 Federal Income Tax Rates. The IRS also announced that the standard deduction for 2022 was increased to the following.

The federal tax brackets are broken down into. The IRS changes these tax brackets from year to year to account for inflation and other changes in economy. The first 10275 of income falls into the 10 tax bracket resulting in a tax of 102750.

In tax year 2020 for example a single person with taxable income up to 9875 paid 10 percent while in 2022 that income bracket rose to 10275. And the standard deduction is increasing to 25900 for married couples filing together and 12950 for single taxpayers. Discover Helpful Information and Resources on Taxes From AARP.

Your 2021 Tax Bracket to See Whats Been Adjusted. As a result taxpayers with taxable income of 523600 or more for single filers and 628300 or more for married couples filing jointly will be subject to the top marginal income tax rate of 37.

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Tax Brackets Calculator 2022 What Is A Single Filer S Tax Bracket Marca

Inflation Pushes Income Tax Brackets Higher For 2022

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Income Tax Brackets For 2022 Are Set

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

Irs Tax Brackets 2022 What Do You Need To Know About Tax Brackets And Standard Deduction To Change In 2022 Marca

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Federal Income Tax Brackets Brilliant Tax

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

2022 Tax Inflation Adjustments Released By Irs

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Income Tax Brackets For 2022 Are Set

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

2021 Federal Income Tax Rates In 2022 Federal Income Tax Income Tax Tax Rate